Present worth is the value found by discounting fu-ture cash flows to the present or base time.

Discounting: The inverse of compounding is determin-ing a present amount which will yield a specified future sum. This process is referred to as discounting. The equa-tion for discounting is found readily by using the com-pounding equation to solve for P in terms of F:

P = F (1+ i )–N

EXAMPLE:

What present sum will yield $1000 in 5 yr at 10 percent?

P = 1000(1.1)-5

= 1000(0.62092)

= $620.92

This result means that $620.92 “deposited” today at 10 percent compounded annually will yield $1000 in 5 yr.

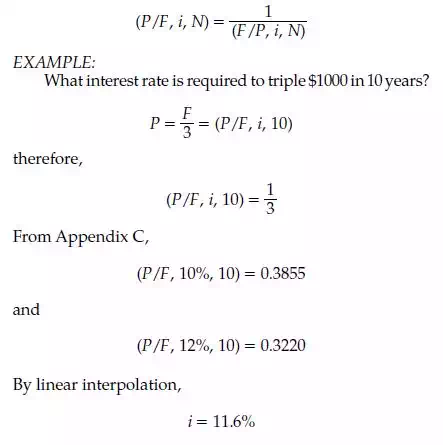

Present worth factor: In the discounting equation, theexpression (1 + i )–N is called the present worth factor and is represented by the symbol (P/F, i, N). Thus, for the present worth of a future sum at i percent interest for N periods,

P = F (P/F, i, N)

Note that the present worth factor is the reciprocal of the compound amount factor. Also note that