There are two considerations in determining benefit-cost criteria. The first pertains to project acceptability, while the second pertains to project selection.

Project acceptability may be based on benefit-cost dif-ference or benefit-cost ratio. Benefit-cost ratio is a measure

of project worth in which the monetary equivalent bene-fits are divided by the monetary equivalent costs. The first criterion requires that the value of benefits less costs be greater than zero, while the second criterion requires that the benefit-cost ratio be greater than one.

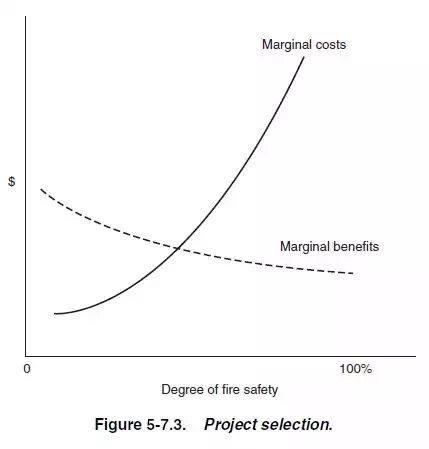

The issue is more complicated in the case of project selection, since several alternatives are involved. It is no longer a question of determining the acceptability of a single project, but rather selecting from among alternative projects. Consideration should be given to changes in costs and benefits as various strategies are considered. Project selection decisions are illustrated in Figure 5-7.3. The degree of fire protection is given on the horizontal axis, while the marginal costs and benefits associated with various levels of fire safety are given on the vertical axis. As the diagram indicates, marginal costs are low ini-tially and then increase. Less information is available con-cerning the marginal benefit curve, and it may, in fact, be horizontal. The economically optimum level of fire pro-tection is given by the intersection of the marginal cost and marginal benefit curves. Beyond this point, benefits from increasing fire protection are exceeded by the costs of providing the additional safety.

A numerical example is given in Table 5-7.3. There are five possible strategies or programs possible. The first strategy, A, represents the initial situation, while the re-maining four strategies represent various fire loss reduc-tion activities, each with various costs. Strategies are arranged in ascending order of costs. Fire losses under each of the five strategies are given in the second row, while the sum of fire losses and fire reduction costs for each strategy is given in the third row. The sum of fire losses and fire reduction costs of each strategy is equiva-lent to the life-cycle cost of that strategy. Life-cycle cost analysis is an alternative to benefit-cost analysis when the outcomes of the investment decision are cost savings rather than benefits per se. Additional information on life-cycle cost analysis is found in Fuller and Petersen.5

Table 5-7.3 Use of Benefit-Cost Analyses in Strategy Selection

| Strategy | |||||

| Category | A | B | C | D | E |

| Fire reduction costs | 0 | 10 | 25 | 45 | 70 |

| Fire losses | 100 | 70 | 50 | 40 | 35 |

| Sum of fire reduction | |||||

| costs and fire losses | 100 | 80 | 75 | 85 | 105 |

| Marginal benefits | 0 | 30 | 20 | 10 | 5 |

| Marginal costs | 0 | 10 | 15 | 20 | 25 |

| Marginal benefits minus | |||||

| marginal costs | 0 | 20 | 5 | –10 | –20 |

| Marginal benefit-cost ratio | — | 3.0 | 1.33 | 0.5 | 0.2 |

Data in the first two rows may then be used to deter-mine the marginal costs or marginal benefits from the re-placement of one strategy by another. Thus, strategy B has a fire loss of $70 compared to $100 for strategy A, so the marginal benefit is $30. Similarly, the marginal benefit from strategy C is the reduction in fire losses from B to C or $20. The associated marginal cost of strategy C is $15. Declining marginal benefits and rising marginal costs re-sult in the selection of strategy C as the optimum strategy. At this point, the difference between marginal benefits and marginal costs is still positive.

Marginal benefit-cost ratios are given in the last row. It is worth noting that, while the highest marginal benefit-cost ratio is reached at activity level B (as is the highest marginal benefit-cost difference), project C is still opti-mum, since it yields an additional net benefit of $5. This finding is reinforced by examining changes in the sum of fire losses and fire reduction costs (i.e., life-cycle costs). Total cost plus loss first declines, reaching a minimum at point C, and then increases. This pattern is not surprising, since as long as marginal benefits exceed marginal costs, total losses should decrease. Thus, the two criteria— equating marginal costs and benefits, and minimizing the sum of fire losses and fire reduction costs—yield identical outcomes.