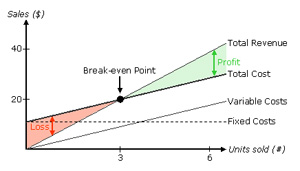

The break-even analysis in production management and industrial engineering consists of total cost (i.e. fixed cost and variable cost) and sales revenue.

A break-even analysis is a financial tool which helps you to determine at what stage your company, or a new service or a product, will be profitable. In other words, it’s a financial calculation for determining the number of products or services a company should sell to cover its costs (particularly fixed costs). Break-even is a situation where you are neither making money nor losing money, but all your costs have been covered.

Break-even analysis is useful in studying the relation between the variable cost, fixed cost and revenue. Generally, a company with low fixed costs will have a low break-even point of sale. For an example, a company has a fixed cost of Rs.0 (zero) will automatically have broken even upon the first sale of its product.

Components of Break Even Analysis

Fixedcosts

Fixed costs are also called as the overhead cost. These overhead costs occur after the decision to start an economic activity is taken and these costs are directly related to the level of production, but not the quantity of production. Fixed costs include (but are not limited to) interest, taxes, salaries, rent, depreciation costs, labour costs, energy costs etc. These costs are fixed no matter how much you sell.

Variablecosts

Variable costs are costs that will increase or decrease in direct relation to the production volume. These cost include cost of raw material, packaging cost, fuel and other costs that are directly related to the production.